How Many Payday Loans Can You Have at Once?

When bills pile up, it’s easy to feel like your options are limited — especially if your credit score isn’t the best.

Payday Loans can provide money quickly when you need it most, which can be a huge relief in the moment. But what if one loan doesn’t fully cover your expenses? Learn about the rules, risks, and alternatives to Payday Loans so you can feel confident about your next financial steps.

KEY TAKEAWAYS

- State regulations vary: Most states limit or prohibit having more than one Payday Loan at a time.

- Know the costs: Payday Loans include additional fees that are important to factor into your budget before borrowing.

- Plan for repayment: Many borrowers choose to renew or extend their loans, so it’s important to have a clear repayment plan you can stick to.

- Explore alternatives: Options like Installment Loans, Earned Wage Access, or community resources may also help (depending on your financial situation).

Can you take out more than one Payday Loan at a time?

While it may be technically possible in some states, most limit or prohibit having more than one Payday Loan at a time. Payday Loan lending is primarily regulated at the state level, which means rules vary depending on where you live.

Even if you live in a state where multiple loans are allowed, taking them on at the same time can create challenges that may outweigh the benefits.

Although payday lending is primarily regulated at the state level, certain federal regulations do apply, including the Truth in Lending Act (which requires clear disclosure of loan terms), the Military Lending Act (which provides additional protections for service members), and various Consumer Financial Protection Bureau (CFPB) rules that govern lending practices.

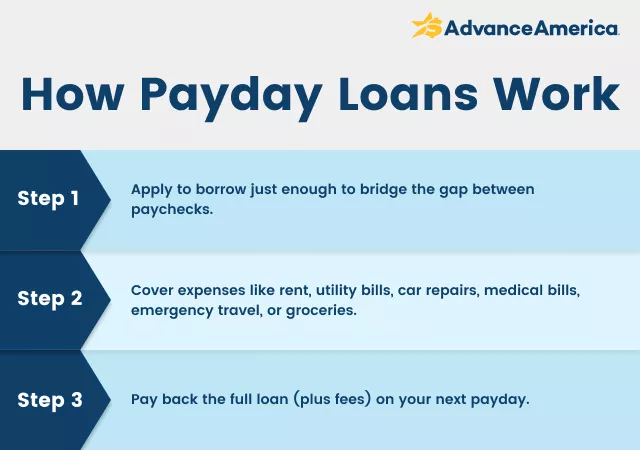

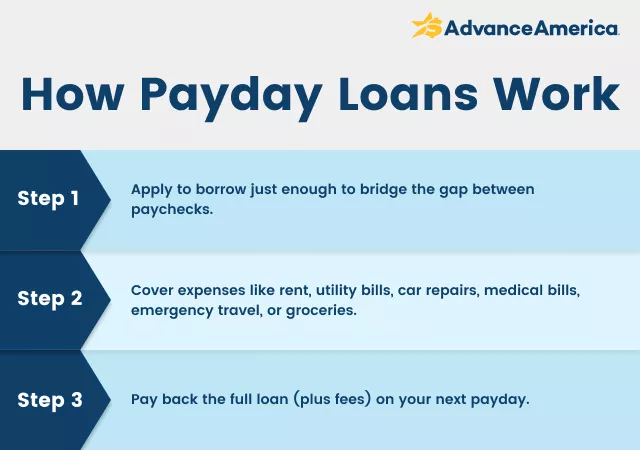

Payday Loan basics

With a Payday Loan, you can quickly borrow a limited amount to handle immediate expenses, then repay the loan in full when you receive your upcoming paycheck. These loans are typically used for urgent expenses like:

- Covering rent or utility bills before your paycheck arrives

- Handling an unexpected car repair

- Paying for a medical bill or prescription

Payday Loan limits and regulations ⚖️

Payday Loans are more tightly regulated than many other loans. Because they’re short-term and come with higher fees, state and federal guidelines are in place to help protect borrowers.

These rules generally fall into a few categories:

- Loan size restrictions: Many states set a maximum dollar amount you can borrow through a Payday Loan.

- Repayment timing: Payday Loans are meant to be short-term, and most states require repayment to coincide with your next paycheck.

- Fee and rate caps: To prevent excessive costs, some states regulate the maximum fees or interest that can be charged.

- Usage limits: Certain states control how often or how many times a Payday Loan can be taken out within a set period.

These guardrails are designed to make borrowing safer and more manageable. The exact rules vary depending on where you live, so it’s important to understand your state’s specific regulations before applying.

State-by-state regulations

Whether you can have more than one Payday Loan depends on your state's specific regulations, as payday lending is primarily regulated at the state level rather than federally. Even so, there are some common types of restrictions that states follow, including:

- Limitations on the number of loans: Some states explicitly limit how many Payday Loans a borrower can have at once. For example, Michigan law allows no more than two active Payday Loans, and lenders must verify you don’t already have two outstanding with other lenders.

- Database verification systems: Some states require lenders to check a centralized database before approving a loan. These databases track active Payday Loans and prevent borrowers from exceeding state limits.

- Cooling-off periods: Several states enforce mandatory waiting periods between loans, ranging from 24 hours to several days depending on the state. For example, Florida requires a 24-hour cooling-off period, while Virginia mandates a minimum of 7 days between loans. Check your state's specific requirements before applying.

- Prohibited states: Some states ban Payday Loans entirely, meaning borrowers must look for alternatives. Some of these states include Arkansas, Connecticut, North Carolina, and more. Search your specific state for payday loan guidelines.

Advance America has been helping customers responsibly manage short-term financial needs since 1997, and we comply with all state and federal laws. That means:

- Advance America complies with all state database verification requirements. In states with loan tracking databases, we check these systems before approving new loans to ensure compliance with state regulations.

- If your state restricts multiple loans, Advance America follows those rules.

- In states where Payday Loans are not allowed, Advance America does not offer them.

Payday Loans: | |||

|---|---|---|---|

| State | Legally Available? | Offered by Advance America? | What You Should Know |

| Alabama | Yes | No, but we offer Installment Loans | Payday Loan amount cannot exceed $500 |

| Alaska | Yes | No | Payday Loan amount cannot exceed $500 |

| Arizona | No | No | Prohibited |

| Arkansas | No | No | Prohibited |

| California | Yes | Yes | Payday Loan amount cannot exceed $300 |

| Colorado | Yes | No | Payday Loan amount cannot exceed $500 |

| Delaware | Yes | No, but we offer Installment Loans | Payday Loan amount cannot exceed $1,000 |

| Florida | Yes | Yes | Payday Loan amount cannot exceed $500 |

| Georgia | No | No | Prohibited |

| Hawaii | No | No | Prohibited |

| Idaho | Yes | No, but we offer Installment Loans | Payday Loan amount cannot exceed $1,000 |

| Illinois | Yes | No | Payday Loan amount cannot exceed $1,000 or 25% of your monthly income (whichever is less) |

| Indiana | Yes | Yes | Payday Loan amount cannot exceed $825 |

| Iowa | Yes | Yes | Payday Loan amount cannot exceed $500 |

| Kansas | Yes | No, but we offer Lines of Credit | Payday Loan amount cannot exceed $500 |

| Kentucky | Yes | Yes | Payday Loan amount cannot exceed $500 |

| Louisiana | Yes | Yes | Payday Loan amount cannot exceed $350 |

| Maine | Yes | No | Terms and rates vary by loan amount |

| Maryland | No | No | Prohibited |

| Massachusetts | No | No | Prohibited |

| Michigan | Yes | Yes | Payday Loan amount cannot exceed $500 |

| Minnesota | Yes | No | Payday Loan amount cannot exceed $350 |

| Mississippi | Yes | Yes | Payday Loan amount cannot exceed $500 (fees included) |

| Missouri | Yes | No, but we offer Installment Loans and Title Loans | Payday Loan amount cannot exceed $500 |

| Montana | Yes | No | Payday Loan amount cannot exceed $300 |

| Nebraska | Yes | No | Payday Loan amount cannot exceed $500 |

| Nevada | Yes | No, but we offer Installment Loans | Payments cannot exceed 25% of your monthly income |

| New Hampshire | Yes | No | Payday Loan amount cannot exceed $500 |

| New Mexico | No | No | Prohibited |

| New York | No | No | Prohibited |

| North Carolina | No | No | Prohibited |

| North Dakota | Yes | No | Payday Loan amount cannot exceed $500 |

| Ohio | Yes | No, but we offer Installment Loans | Payday Loan amount cannot exceed $1,000 |

| Oklahoma | Yes | No, but we offer Installment Loans | Payday Loan amount cannot exceed $500 |

| Oregon | Yes | No | Loan term cannot be less than 31 days |

| Pennsylvania | No | No | Prohibited |

| Rhode Island | Yes | Yes | Payday Loan amount cannot exceed $500 |

| South Carolina | Yes | No, but we offer Lines of Credit and Title Loans | Payday Loan amount cannot exceed $550 |

| South Dakota | Yes | No | Payday Loan amount cannot exceed $500 |

| Tennessee | Yes | Yes | Payday Loan amount cannot exceed $500 |

| Texas | Yes | Yes, as Cash Advance Loans | Traditional payday lenders can offer loans up to $500; those operating as credit access businesses (like Advance America) can offer more |

| Utah | Yes | No, but we offer Installment Loans and Title Loans | No maximum loan amount |

| Vermont | No | No | Prohibited |

| Virginia | Yes | No | Payday Loan amount cannot exceed $500 |

| Washington | Yes | No | Payday Loan amount cannot exceed $700 or 30% of monthly income |

| West Virginia | Yes | No | Payday Loan amount cannot exceed $500 |

| Wisconsin | Yes | No, but we offer Installment Loans | No limit on interest rate before the loan’s maturity date |

| Wyoming | Yes | Yes | Maximum loan term is one calendar month |

* Information current as of Sept. 2025. State regulations regarding Payday Loans change frequently. For the most up-to-date information, please check your state's financial regulatory website or contact your local Advance America. | |||

Remember that Payday Loan laws are constantly changing. States often change legislation on dollar amount limits, interest rates, and whether Payday Loans are allowed. Always check your state’s laws before attempting to take out more than one Payday Loan.

What to consider before taking out multiple Payday Loans

Taking out a Payday Loan can be a quick way to cover expenses, but borrowing multiple loans at once comes with some risks. Before considering more than one, it’s important to understand how it can impact your finances and repayment ability.

Debt cycle and rollovers

Taking out multiple Payday Loans requires careful planning. Some states offer the option to roll over loans for borrowers who can’t repay on time. Although this can extend your repayment period, it’ll increase the amount you’ll ultimately need to pay back.

Fees and interest

Payday lenders may charge fees, interest, or a flat rate based on the amount borrowed. These are important to factor in when considering multiple loans. Keeping these costs in mind can help you budget effectively and make sure you’re comfortable with the repayment plan.

Impact on credit and banking

While Payday Loan lenders don’t usually report your loans to credit agencies, they may report missed payments or defaulted loans. Manage multiple loans carefully to help you avoid unnecessary fees or account issues while keeping your finances on track.

Alternatives to Payday Loans

Payday Loans are designed to help with short-term expenses, but you can also consider alternative options to create a financial plan that works for your needs.

Installment Loans

An Installment Loan is a lending option that lets you borrow a specific amount of money that you’ll repay over time through scheduled (typically monthly) payments. Installment loans break repayment into smaller amounts, which can make budgeting easier.

Depending on the lender, these loans may offer more flexible terms and a longer repayment period.

➢RELATED: Payday Loan vs. Installment Loan: What’s the Difference?

Earned wage access (EWA)

If you need money quickly, earned wage access programs can let you access a portion of your paycheck before your official payday. Many employers and financial apps offer this option, giving you quicker access to your own money without taking out a traditional loan.

An EWA can be a convenient way to cover unexpected expenses while avoiding additional borrowing.

Local credit unions or community support

A local credit union or community organization may provide small-dollar loan options or emergency assistance. Credit unions can usually offer lower interest rates, and community support services can connect you with resources tailored to your situation.

Exploring these options can provide alternatives that meet your needs while supporting long-term financial stability.

➢RELATED: Need Money Now? 13 Ways to Get Cash Today

Know the limits before you borrow

There’s no one-size-fits-all answer about whether you can take out multiple Payday Loans at once. In many states, this practice is restricted or prohibited — and even where it’s allowed, it could create more challenges than solutions.

The key is to know your limits, fully understand your options, and choose the path that helps you feel most confident about your financial future.

FAQs

Can I have more than one Payday Loan at a time?

It depends on your state’s laws. Some states limit or prohibit having multiple Payday Loans at once, while others allow it up to a certain amount. Always check local regulations before applying.

Do Payday Loans affect my credit score?

Most Payday Loan lenders don’t report to major credit bureaus. However, if a loan goes unpaid and is sent to collections, it could impact your credit. Paying on time helps you stay on track.

What happens if I need more time to repay a Payday Loan?

Some borrowers choose to renew or extend their loan. Availability depends on state laws and lender policies, so it’s best to discuss your options with your lender before the due date.

How can I make sure I borrow responsibly?

Borrow only what you need, review your budget before applying, and create a repayment plan you feel confident about. This way, you’ll use Payday Loans as a helpful tool without extra stress.

MORE ON BORROWING:

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.