What Is Discretionary Income?

Are you eager to travel, but can't bridge the gap between your wanderlust and your wallet? If this sounds familiar, it may be time to increase your discretionary income.

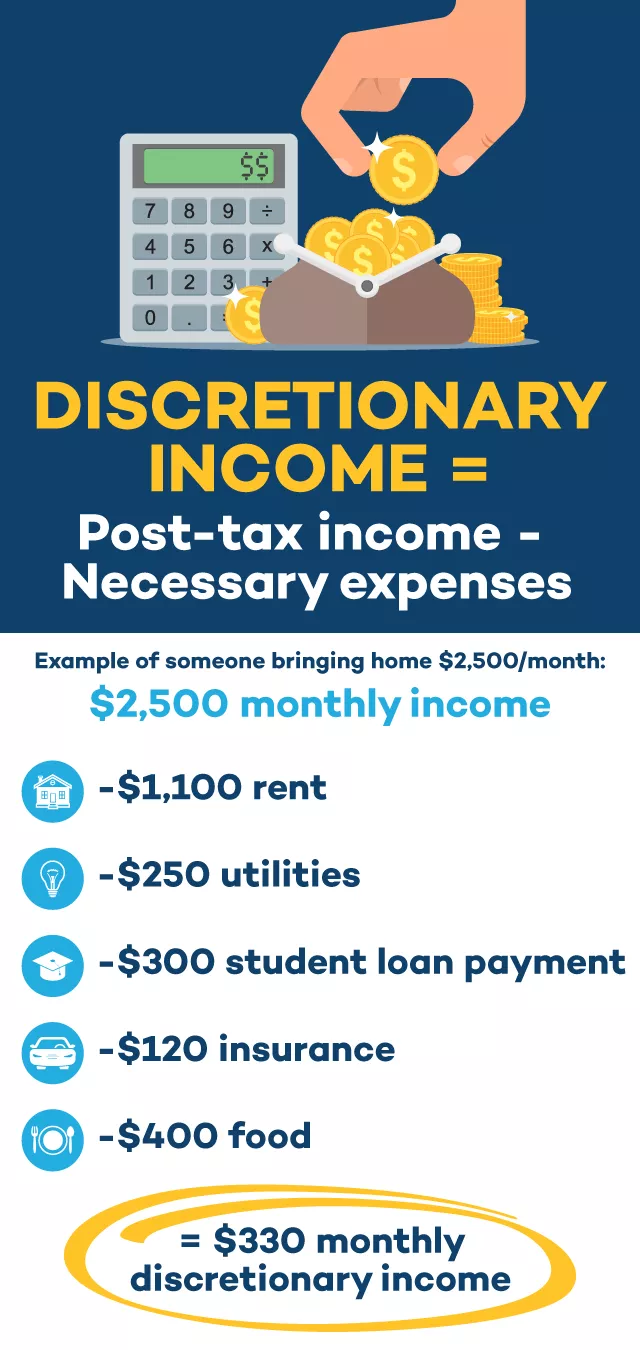

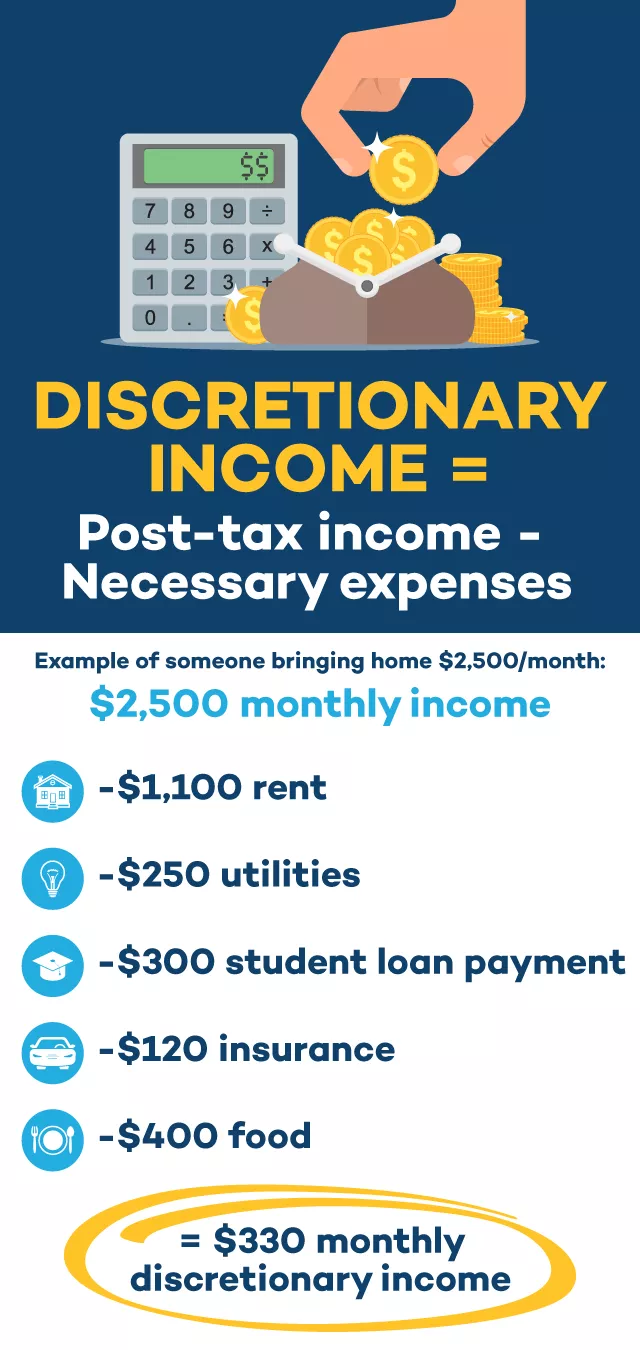

Discretionary income definition

Discretionary income is the money you have left after paying taxes and necessary expenses. Necessary monthly expenses include housing, groceries, insurance, utilities, and other essentials.

In other words, it’s the amount of money you have available to save, invest, or spend on non-essential purchases.

Discretionary income vs. disposable income

While similar, discretionary income and disposable income are different.

Disposable income is your net pay. This is the amount of money you bring home after taxes.

Discretionary income goes a step further, subtracting both taxes and essential expenses.

How to calculate discretionary income

If you’re trying to budget for a big expense like travel, you’ll need to know how much post-tax money you have left after paying for personal necessities.

To calculate your discretionary income, start with your disposable income (remember, this is your take-home pay after taxes) and subtract necessities like rent, utilities, food, healthcare, car payments, and loan payments. If you're self-employed, be sure to account for any estimated tax payments. The remaining amount is your discretionary income.

How do I maximize my discretionary income?

Now that you know how to calculate discretionary income, you may discover that yours needs a boost. Fortunately, there are several ways to increase discretionary income:

Negotiate a raise

Increasing your regular income is the most direct way to free up extra money. Even a modest amount of extra income can improve your financial situation and expand your travel possibilities.

Here are a few tips to help you negotiate a higher salary:

- Research market rates. Look up job listings for similar positions in your industry and location. Note current salary ranges so you know what's fair and competitive.

- Practice your pitch. Go into the discussion prepared to demonstrate why you deserve a raise. Confidence is key.

- List your accomplishments. Highlight the value you've brought to the company. Note any major projects you've worked on, recognitions you've earned, or specific metrics you've influenced (such as cost savings, revenue, etc.).

- Stay positive. No matter the outcome, remain professional and express gratitude for the opportunity to discuss your salary.

- Explore other opportunities. If your employer is unable to give you a raise, it may be time to move on. Consider how switching jobs might boost your discretionary income and give you the compensation (and vacation time!) you deserve.

Earn extra money with a side gig

Not ready to switch jobs? Try a side gig!

Taking on a flexible gig outside your regular job can help you earn extra money to meet big financial goals. Even a temporary gig can help you pay off credit cards, build an emergency fund, or plan a nice vacation!

Minimize your tax liability

Taking advantage of tax deductions and credits can reduce the amount of money you owe the IRS, leaving more for discretionary spending.

You can reduce your tax liability by:

- Keeping track of eligible expenses to claim deductions.

- Exploring tax credits for education, home ownership, or energy-efficient home improvements.

- Contributing to a health savings account.

Reduce your monthly expenses

The fewer monthly expenses you have, the more money you can put toward a vacation or emergency fund. Even small cuts can have a big impact on your monthly budget. For example, you might try:

- Switching to generic products.

- Using utilities more efficiently.

- Running multiple errands in one trip to reduce gas.

- Thrifting before shopping at major stores.

Pay off debt

Try to get out of debt quickly to save money on interest. There are many strategies you can use, but if you want to focus on credit cards and loans with the highest interest rates, try the debt avalanche method.

Working toward paying off debt may reduce your discretionary income in the short run, but doing so will free up more money down the road.

Make short-term investments

You don't need to put your money into long-term investments to see results. For example, a high-yield savings account typically offers better interest rates than traditional savings accounts, helping your money grow over time.

CDs, or certificates of deposit, are also a great short-term investment. They provide a fixed interest rate for a specified period, allowing you to earn a predictable return in a few months or years.

Discretionary income and travel

Travel is a non-essential expense. As such, vacationing falls under the category of discretionary spending. The more discretionary income you have, the more you can travel.

When you live paycheck to paycheck, you may have to get creative to plan a vacation. This could either mean choosing budget-friendly vacation destinations, limiting how often you travel, or earning more money.

>RELATED: 7 Tips To Save Big On Travel

Vacation tips for maximizing discretionary income

Planning your dream vacation without going into debt can be tricky. Here are some travel tips to keep your budget in check:

Choose a budget-friendly vacation destination. No amount of financial planning can stretch a motel budget into an all-inclusive getaway. Keep that dream destination in mind for future travel but be honest with yourself about your current finances – and the type of trip you can realistically afford.

Start a vacation fund savings account. Money has a way of disappearing when left in a regular checking account. Opening a separate account for specific savings goals like travel can keep your money safe from impulse buys.

Travel light. When flying, pack everything into a carry-on bag to avoid checked baggage fees. Traveling light also helps you avoid luggage storage fees at your destination.

Simplify your itinerary. Take advantage of free attractions like public museums, historical sites, parks, and art walks. Guided tours and excursions are great, but exploring on your own is cheaper.

Avoid peak-season travel. Many budget-minded travelers have managed to visit dream destinations by traveling in the off season. The off season varies by location, but it refers to the time of year that experiences the least tourist activity. Not only will you save money, but you’ll avoid peak-season crowds!

Bottom line

Reducing your monthly expenses is good for any financial plan, but you can't beat having extra money for the occasional splurge! Understanding discretionary spending and how it relates to travel expenses can help you take more effective steps toward boosting your income and making future travel plans.

Improving your financial situation takes time, but what if you've already planned a trip and you're short on travel funds? A personal loan from Advance America can help cover your expenses, regardless of your credit score. Apply online 24/7 or visit your nearest store to learn more.

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.