Payday Loans for Bad Credit: How Do They Work?

Payday Loans offer a safe, quick way to access emergency funds. You can use the money to cover expenses such as car repairs, medical bills, or everyday essentials like groceries and utility bills until your next paycheck.

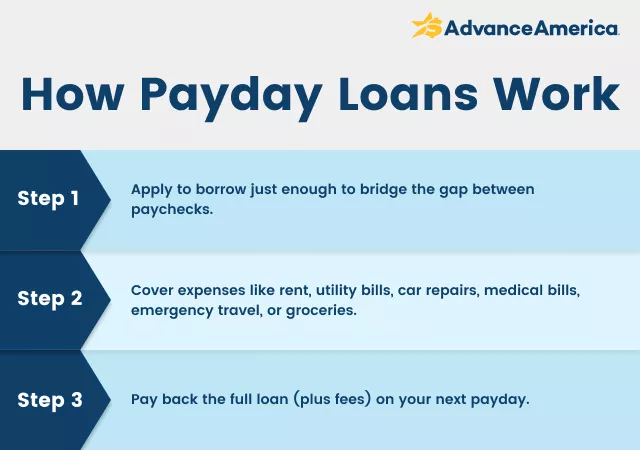

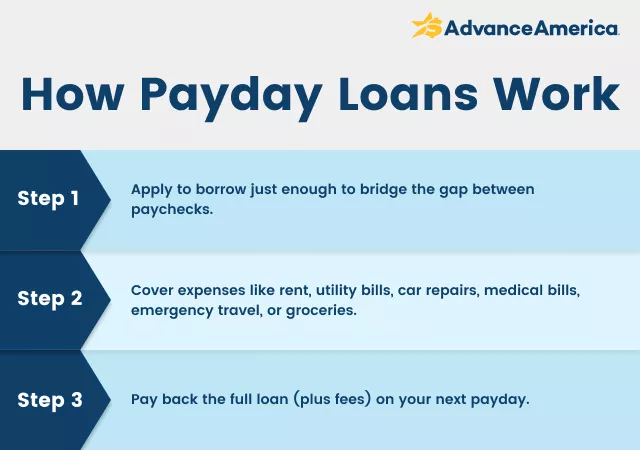

How do Payday Loans for bad credit work?

As mentioned, a Payday Loan is designed to provide you with extra cash to cover expenses until your next paycheck. These loans are a reliable option for consumers with all types of credit — including bad credit or no credit — because they require no credit check when applying. Instead, lenders base their approval decisions on factors such as your income and employment history, making Payday Loans a great option if you need cash fast.

At Advance America, we offer same-day funding for applications approved before 10:30 AM EST.

The amount you can borrow from a Payday Loan is usually based on a portion of your expected paycheck — usually a couple of hundred dollars or less, though it could reach $1,000+ for some borrowers. You then use the funds for your needs and repay the loan in full on your next payday, typically within two to four weeks.

What do you need to apply for a bad-credit Payday Loan?

Applying for a Payday Loan with poor credit is straightforward, with many lenders offering in-store or online applications. Before you start the loan application process, make sure you have the following information on hand:

- Social Security number

- Email address

- Checking account information

- Proof of income

Can you get a Payday Loan with bad credit online?

Yes. Direct lenders like Advance America may offer Payday Loans online in addition to our 800+ storefront locations. It doesn’t matter where you apply—you can get the funds you need online or in-store quickly via direct deposit.

Reasons to consider a Payday Loan for bad credit

Payday Loans offer several benefits for potential applicants, including:

| Reason to consider | How it can help |

|---|---|

| Easy application | Payday Loans often come with easy applications that borrowers can complete online or in-store. In fact, you may be able to apply in just a few minutes from the comfort of home. |

| Quick approval | Once you apply for a Payday Loan, you should receive an instant or quick approval decision. Funding times vary by lender. |

| Good credit not required | Bad credit, good credit, or no credit history at all; it doesn’t matter when you apply for a Payday Loan. Instead, lenders consider your ability to repay the loan on your next payday, meaning you may still get approved even if you have bad credit. |

How much does a Payday Loan for bad credit cost?

Rates vary by state, but you’ll typically pay about $15 to $20 fee for every $100 you borrow. The state you live in will also determine the amount you can borrow. Remember, you’re responsible for any interest or fees associated with late or missed payments, so borrow responsibly.

Even though a Payday Loan does cost money, it can be a more affordable alternative to overdraft charges, credit card late fees, and bounced checks, especially when you know you can repay the loan as scheduled.

Alternative loan options if you have bad credit

While Payday Loans for bad credit can be a good option for many borrowers, they may not be right for everyone. If you need a Cash Advance but don’t want a Payday Loan, consider these alternatives:

Installment Loans

Installment Loans for bad credit provide a lump-sum payment up front. You’ll pay the loan back over time (anywhere from a few months to several years) via fixed monthly payments or installments. These loans may make sense if you need a large amount of cash at once.

Car title loans

Car title loans for bad credit are secured loans that use your car as collateral. Upon approval, you’ll give the lender your title in exchange for a lump sum of cash, based on the value of your vehicle. You can drive your car while repaying your loan. If you own your car and are willing to use your title as collateral, a title loan through our partnership with LoanCenter may be a good fit.

Personal Lines of Credit

With a personal Line of Credit, you can withdraw money whenever you’d like up to a set credit limit, and you’ll only pay interest on the amount you borrow. A Line of Credit should be on your radar if you’d like a flexible loan but aren’t sure exactly how much you need to borrow right now.

Tips for improving your credit

While bad credit limits your loan options, the higher your credit score, the better your future loan rates and terms will be. Because of that, it’s critical to improve your credit health as much as possible. If you’re not sure what your credit score is, visit AnnualCreditReport.com to check your credit report every year. Next, remember these useful tips:

- Pay your bills on time. Even one late payment can ding your credit. Focus on paying all your bills on time, including your mortgage, utilities, auto loans, and credit cards.

- Use autopay. If you struggle to remember your payment dates, enroll in automatic payments or set calendar reminders on your phone so you don’t forget and miss a payment.

- Keep your credit accounts open. Your credit history length directly affects your credit score. Generally, the longer you’ve had your credit accounts open and in good standing, the higher your score. If you can, keep your old accounts open, even if you don't plan to use them or have a zero balance.

- Reduce your credit utilization ratio. The amount of debt you have divided by the amount of credit available to you is known as your credit utilization ratio. Since most lenders prefer a ratio below 30%, it’s important to reduce it by paying down your balances.

Get an Advance America loan today

Whether you need a Payday Loan, an Installment Loan, or a Line of Credit, you can apply for one with Advance America. Regardless of which loan you choose, we offer competitive interest rates, fast turnaround, and no hidden fees.

Advance America has issued more than 157 million loans since 1997 and has more than 200,000 authentic customer reviews on Google and Trustpilot. And best of all? You don’t need great credit to qualify.

Ready to apply? Let’s get started!

Sources

- CFPB: Market Snapshot Consumer Use of Payday Loans: cfpb_market-snapshot-payday-loan-extended-payment-plan_report_2022-04.pdf

- CFPB: What Do I Need to Apply for a Payday Loan?: https://www.consumerfinance.gov/ask-cfpb/what-do-i-need-to-qualify-for-a-payday-loan-en-1593/

- Trustpilot: Advance America Reviews: https://www.trustpilot.com/review/advanceamerica.net

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.