Understanding the Different Types of Credit Scores

We’ve all heard that it’s important to have a good credit score. What most people don’t realize is that there are different types of credit scores, and they aren’t all viewed the same by lenders. Understanding what a credit score is and the different types out there may help you secure more favorable loans in the future.

What is a credit score?

A credit score is a three-digit number that lenders use to assess how risky it may be to lend you money. It considers your financial history and predicts your ability to repay debt.

While a high credit score indicates you may be responsible with money, a low credit score suggests that you could be a risky borrower. The higher your credit score, the easier it typically is to get approved for the loans you want.

Did you know your credit score carries a lot of weight in your everyday life? From getting approved for a car loan to renting an apartment and setting up utilities, lenders and service providers often consider your credit score before making a decision.

Most popular types of credit scores

There are hundreds of specific credit scores available, but they generally fall into two main model types: FICO and VantageScore. Each of these models also offers different versions, including "base" scores for general use and "industry-specific" versions, such as Auto or Bankcard scores.

FICO score

FICO scores were created by the Fair Isaac Corporation and are considered the gold standard of credit scores. FICO scores range from 300 to 850, with 300 being the worst and 850 being the best. FICO considers five factors when calculating your credit score:

- Payment history

- Credit utilization

- Length of credit history

- New credit

- Credit mix

There are also different types of FICO scores depending on the type of loan you’re applying for. One example is if you’re applying for a car loan versus a credit card. For credit cards, lenders check your FICO Bankcard Score, but for a car loan, they’ll check your FICO Auto Score.

If you’re wondering how your FICO credit score stands on their scoreboard, here’s how they rank the different score ranges:

| Credit Score Ranges for FICO | |

|---|---|

| Poor | 300 - 580 |

| Fair | 580 - 669 |

| Good | 670 - 739 |

| Very Good | 740 - 799 |

| Exceptional | 800 - 850 |

VantageScore

Although not as widely recognized as FICO, VantageScore is the second most widely recognized type of credit score. The VantageScore formula is similar to the FICO score formula, utilizing many of the same scoring factors and also having a scoring range of 300 to 850.

The difference between FICO and VantageScore lies in the emphasis placed on specific factors. VantageScore primarily considers your credit utilization ratio and credit card balances, while FICO places the most importance on your payment history.

VantageScore also has a different ranking system for how it gauges your credit score:

| Credit Score Ranges for VantageScore | |

|---|---|

| Subprime | 300 - 600 |

| Near Prime | 601 - 660 |

| Prime | 661 - 780 |

| Superprime | 781 - 850 |

➢RELATED: What is Considered a Good Credit Score?

Other types of credit scores

While FICO and VantageScore are the most common credit score models, they aren’t the only ones.

- Auto insurance credit score: Car insurance companies rely on a standalone credit score that considers your auto claims history to calculate your premiums.

- Home insurance credit score: As with car insurance, home insurance companies use their own credit-based insurance score rather than a traditional credit score. While your credit plays a role, they also focus on your specific home and neighborhood when calculating your home insurance score.

- Credit union scores: There are also several major credit unions, including Equifax, TransUnion, and Mint, that use their own credit scores. Their scoring models and formats are similar to FICO and VantageScore, but they each have subtle and unique differences.

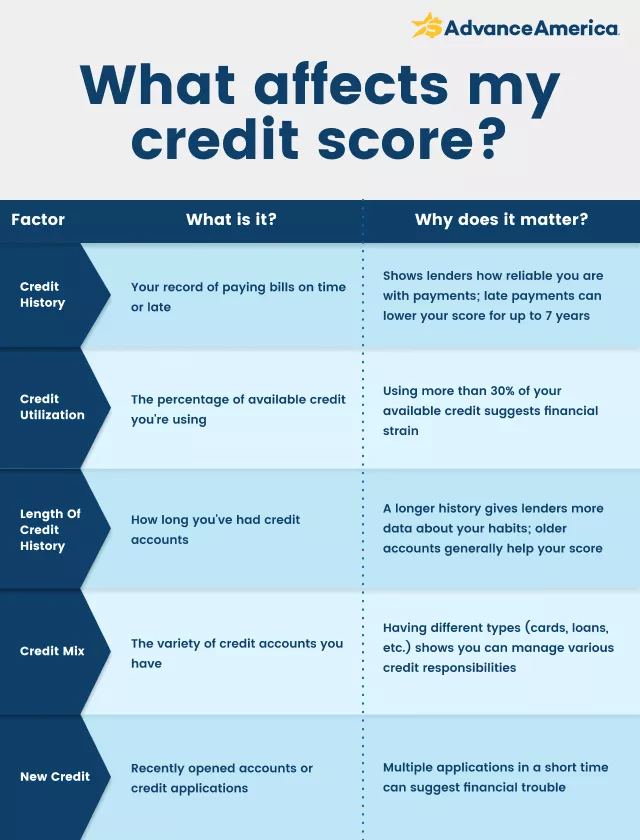

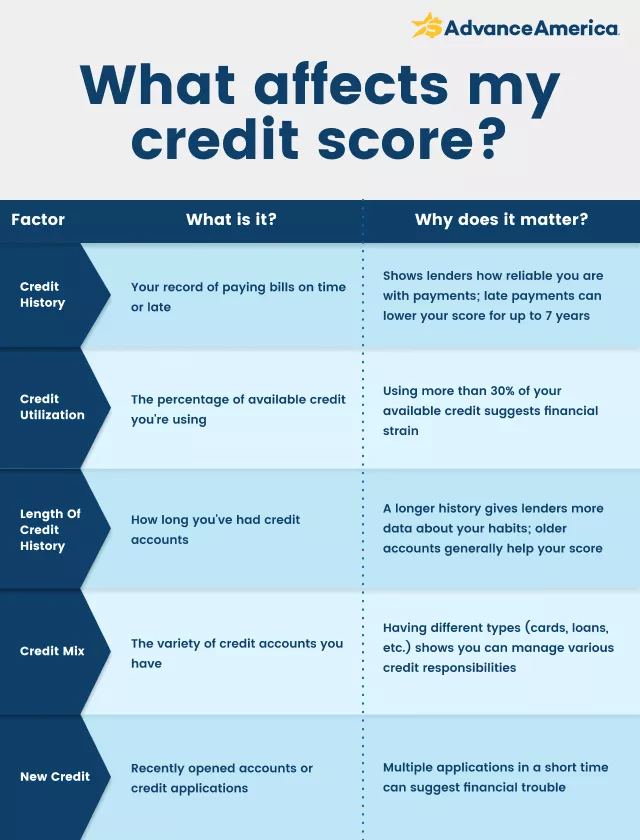

How is each credit score calculated?

Your credit score is determined using several key factors, including payment history, credit utilization (also called debt-to-credit ratio), and the length of your credit history.

- Payment history is your record of on-time or missed payments on outstanding debts and loans. This includes payments on credit cards, your mortgage, car loans, student loans, and more. It can also include payments on rent and your monthly utility bills.

- Credit utilization refers to how much of your available credit you use and typically applies to credit cards and Lines of Credit. You can calculate your credit utilization ratio by dividing your current balances by your total credit limits, then multiply by 100. The lower your credit utilization ratio, the better the impact your credit score.

- Length of credit history refers to how long your credit accounts have been open. It also includes how long you’ve been paying off your loans and debts. Since it’s easier to maintain good credit for a short period, having a long credit history will boost your credit score because it shows long-term reliability.

Now, let's examine the scoring systems of FICO and VantageScore to better understand how each of these factors affects your credit score.

FICO score calculation

FICO credit scores are based on payment history, amounts owed, length of credit history, new credit, and credit mix. Here’s a percentage breakdown of the importance of each factor.

- Payment history: 35%

- Your payment history reflects your ability to repay debts and loans on time.

- Amounts owed: 30%

- The more money you owe, the more likely you are to fail to make on-time payments.

- Length of credit history: 15%

- The longer your credit history, the longer your track record of being responsible with your money and managing your debts.

- New credit: 10%

- Opening multiple new credit accounts simultaneously is a red flag for lenders. It could indicate that you’re maxing out your credit accounts or tend to take on a lot of debt.

- Credit mix: 10%

- Having a mix of different types of credit accounts is beneficial for your credit score. That includes different types of personal loans, business loans, credit accounts, and more.

While this is the general rule for calculating FICO scores, there may be exceptions. For instance, if you don’t have a long credit history, your score might be calculated differently from someone with a lengthy one. As such, it’s vital to remain in good standing in as many categories as possible.

➢RELATED: Does Closing a Credit Card Hurt Your Credit Score?

VantageScore calculation

VantageScore credit scores are calculated similarly to FICO scores, but with several small differences. Rather than assigning a percentage to each scoring category, VantageScore indicates how influential they are.

- Payment history: Highly influential

- This category is just as important as it is for a FICO score.

- Credit utilization: Highly influential

- Credit utilization is the same as “amounts owed” for a FICO score, and it’s of equal importance.

- Depth of credit: Highly influential

- Your credit history and length are more important to your VantageScore than your FICO score.

- Balances: Slightly influential

- The balance you owe on each credit account or loan balance isn’t a factor for FICO scores. With VantageScore, however, it has a slight impact on your credit score.

- Recent credit activity: Less influential

- Recent credit activity is the same as FICO’s “new credit” category and is of similar importance.

- Total available credit: Less influential

- Showing that you don’t use up all the credit you have available helps your credit utilization ratio and improves your credit score.

As with FICO, the best way to ensure a VantageScore is to practice good financial behavior across all the categories.

Even small habits — like keeping balances low and paying bills on time — can help you steadily improve your score, no matter which model a lender uses.

How to check your credit score

There are several ways to check your credit score for free. The best way is to visit AnnualCreditReport.com and pull your credit reports from Experian, Equifax, and TransUnion once a year. You can also check your FICO score in your credit card account or your VantageScore through Experian.

➢RELATED: What Is the Average Credit Score by Age?

Why do credit scores differ?

If you just checked your credit score from FICO and VantageScore, you might’ve been surprised to see that they weren’t the same. Here’s why:

Different scoring systems

Even though VantageScore and FICO use the same scoring range (300–850), they don’t measure things the same way. Each one looks at your credit history a little differently and weighs certain factors more heavily than others. That’s why your score can vary depending on which model is being used.

Different information

VantageScore and FICO also do not operate with the same information. Individual creditors can decide which credit bureaus they want to report your information to, which means TransUnion might know something that Experian doesn’t.

This means that VantageScore and FICO will have two different sets of data, resulting in different credit scores.

Different schedules

Credit reporting services operate on different schedules. Some report your credit activity daily or weekly, while others do so monthly.

It’s important to use the most up-to-date information available if you want an accurate report of your credit score.

Is one credit score more important than the other?

Not really. Neither score is considered more important or “better” than the others, and you usually won’t know which one a lender is checking when you apply.

That’s why the smartest move is to focus on healthy financial habits — like paying bills on time and keeping balances low. When you do that, you’ll boost your credit no matter which scoring model is used, and you won’t have to stress about which number shows up.

MORE ON CREDIT SCORES:

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.