Who’s Getting a Cash Advance in 2026? You Might Be Surprised

According to the Consumer Financial Protection Bureau, today's users of cash advances are diverse, strategic, and increasingly empowered. They're making savvy, proactive, intentional choices to smooth out timing gaps between expenses and income.

KEY TAKEAWAYS

- Cash advances have evolved into flexible financial tools used by a broad range of people.

- New research shows users are proactive, informed, and leveraging advances to manage rising costs.

- Cash advances come in different forms, such as Payday Loans and Personal Lines of Credit.

- Tools like online applications, real-time updates, and mobile access make borrowing easier to manage than ever.

What is a cash advance?

A cash advance is a convenient way to access money when you need it most. At Advance America, you can get a cash advance in the form of a:

- Payday Loan. A short-term loan that allows you to borrow a percentage of your paycheck. Typically, you’ll repay the amount in full on your next payday.

- Line of Credit. A reusable safety net that allows you to access money as needed (up to an approved limit).

These cash advance options are designed to support real-life needs by bridging the gap between paychecks.

➢RELATED: 8 Questions to Ask Before Getting a Cash Advance Loan

A new kind of borrower

As of 2025, inflation remains a top concern for households — and more people are taking a proactive approach to their finances by exploring flexible options like cash advances.

According to recent research from Pew Charitable Trusts, today’s borrowers use cash advances as tools to help with rising costs, unexpected expenses, or temporary budget gaps. They’re using them as a smart financial bridge, not a last resort.

Who uses cash advances in 2026?

The cash advance conversation has changed. Once stereotyped as a tool of desperation, cash advances are now used by a wide range of everyday Americans — many of whom are managing jobs, side hustles, and long-term goals with care.

The profile of short-term credit users has expanded. It's no longer about financial distress — it's about financial flexibility.

Full-time workers 👩💼

Many cash advance users work full-time and are doing their best to manage the rising costs of everyday essentials. With inflation affecting rent, groceries, and transportation, even salaried workers can experience temporary cash gaps between paychecks.

Middle- to higher-income earners 💳

According to the CFPB, nearly 1 in 4 adults with annual incomes between $50,000 and $100,000 used a small-dollar loan or cash advance product in 2023. These aren’t high-risk borrowers; they’re strategic spenders looking to avoid credit card debt or overdraft fees.

Gen Z and early career professionals 🧑🎓

Young professionals are entering the workforce with steady incomes but may not yet have built strong credit profiles. For them, short-term cash options like advances are a way to manage expenses, pay off balances quickly, and feel empowered about their finances.

College-educated borrowers 🎓

Higher education doesn’t eliminate the occasional need for short-term liquidity. Whether it’s covering upfront travel costs for a wedding, booking concert tickets before they sell out, or paying a deposit for a new apartment, college-educated borrowers use cash advances to time their spending responsibly.

Retirees on fixed incomes 👵

Even with careful budgeting, retirees may face timing gaps — especially when waiting for Social Security payments, pensions, or annuity disbursements. Cash advances can help cover medical costs, prescription co-pays, or emergency home repairs without dipping into long-term savings.

Caregivers and ‘sandwich generation’ adults 🧑🍼

Adults supporting both children and aging parents often face unpredictable expenses. From last-minute daycare fees to elder care supplies, caregivers use cash advances to handle urgent costs that fall between paychecks or before reimbursement.

Why more Americans are turning to a cash advance in 2026

People aren’t turning to cash advances because they’re a last resort. They’re doing it because they’re making smart, real-time decisions about their cash flow.

Using credit products doesn’t necessarily mean people are in crisis. It can reflect proactive financial planning when money is tight.

Here are some of the top reasons consumers say they use cash advances:

🛒 Rising cost of living

From groceries to gas, inflation continues to squeeze budgets — even for those who earn steady incomes.

➢RELATED: How to Find Help Paying Your Bills This Month

💳 Avoiding credit card debt

Rather than rack up credit card debt, some choose a small-dollar loan or cash advance they can repay quickly.

🏘️ Rent, utilities & timing gaps

Sometimes rent is due before payday. Or utility bills spike during peak seasons. A cash advance can provide a short-term cushion without affecting other bills.

➢RELATED: Need Help Paying Rent? 5 Ways to Get Emergency Rent Assistance

💼 Gig & shift workers

Those who rely on tips, freelance income, or irregular hours can face variable paychecks. A cash advance helps them smooth out their income.

📚 Seasonal expenses

Some costs only come around once or twice a year — but when they do, they hit hard:

- Back-to-school shopping for growing kids

- Holiday gifts and travel expenses

- Summer camp deposits

- Seasonal home maintenance or weather-related energy bills

Cash advances can offer the flexibility to cover these costs without derailing your monthly budget.

➢RELATED: 31 Ways to Get Free & Discounted School Supplies in 2025

🎉 Life events & FOMO spending

We’re living in a post-pandemic world where people value shared experiences. A last-minute concert, travel with friends, or family milestone celebration can trigger a need for short-term funds.

According to Pew, 7 in 10 borrowers use payday-style loans to cover recurring expenses like rent, groceries, or utility bills — not because they’re careless with money, but because they’re managing tight budgets with precision.

Why people choose cash advances

Today’s cash advances aren’t just fast — they’re flexible, accessible, and built for real life. In 2026, borrowers appreciate the ability to:

- Apply anytime from a phone, laptop, or tablet

- Get real-time updates on application status

- Upload documents digitally — no fax machine required

- Select repayment terms that match their budget and timeline

These modern tools give borrowers more control — not just over the application process, but over their finances. Whether someone needs to cover a surprise expense or bridge the gap until payday, cash advances provide:

- ✅ Convenience. Apply online in minutes, without paperwork hassles or long waits

- ✅ Speed. Receive funds fast, sometimes the same day

- ✅ Flexibility. Choose the type of advance and repayment plan that fits your situation

With digital access and borrower-friendly features, it’s no surprise that more people are choosing cash advances as smart tools for managing timing gaps.

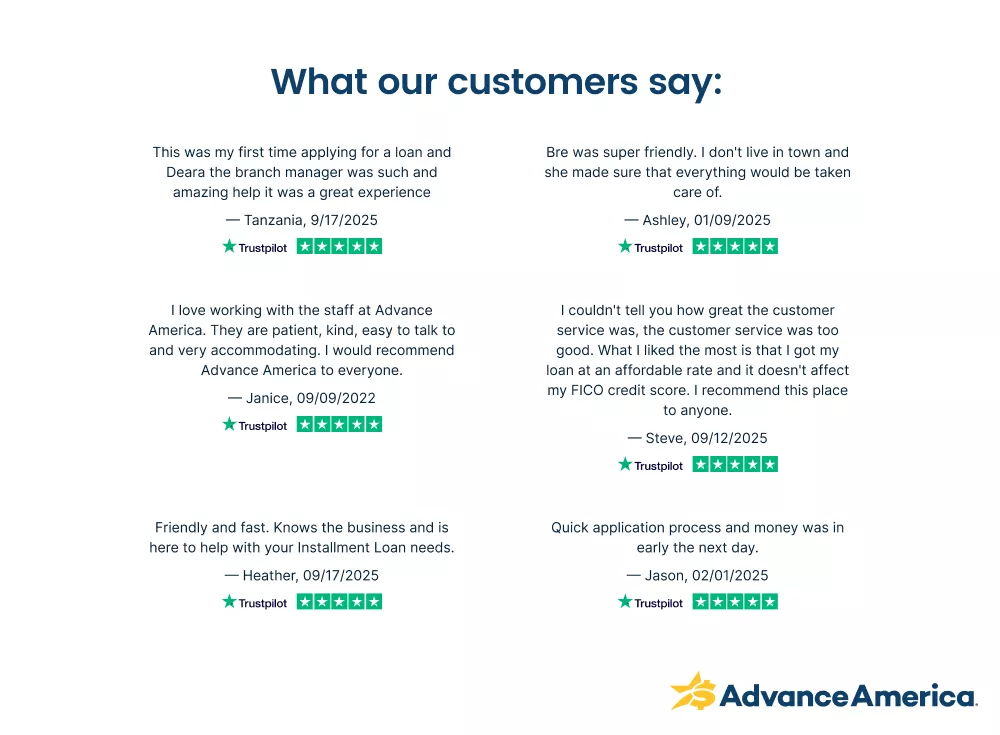

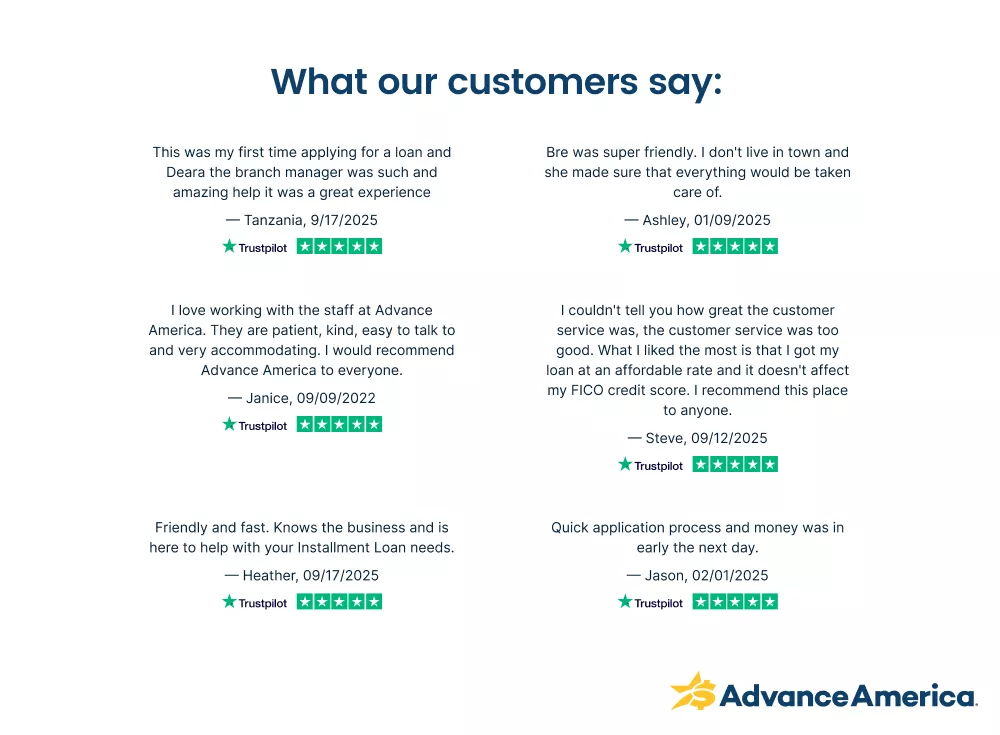

Why customers choose Advance America Cash Advances

How digital tools are making cash advances easier — and smarter 🔧

The term "cash advance" might sound old-school, but the experience is anything but.

Today’s cash advance experience looks nothing like it did a decade ago. Thanks to technology, consumers can apply, track, and repay with more control than ever.

🔒 Enhanced online security

Digital lenders use encryption and verification tools to keep personal and financial information safe.

📱 Mobile applications

Consumers can apply from their phones, upload documents securely, and get updates on their application in real time.

📊 Financial literacy built into platforms

Many platforms now offer budgeting tips, payoff calculators, and tools that help borrowers understand their loan terms and avoid taking on more than they can handle.

🏢 Earned wage access from employers

Some companies now partner with financial service providers to offer early access to earned wages — another version of a cash advance that supports workers without pushing them into debt.

Explore your options with confidence

At Advance America, we know money decisions are personal. That’s why our financial solutions are designed to work with your schedule, your needs, and your real life.

💡 Curious about which of our Cash Advances might fit your needs?

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.