Tax Guide: How to File Your Taxes in 2026

Tax season is just around the corner! Let’s review this year’s filing deadlines, forms, and resources to help you prepare.

Do you need to file taxes?

Whether you need to file taxes depends on a number of factors:

- Age

- Income

- Filing status

- Employment status

- Dependent vs. independent status

While some people may be excluded, most U.S. citizens and permanent residents must file their taxes yearly. This is because most people earn more than the filing minimum, which varies based on age, marital status, and whether you’re the head of your household.

Even if you don’t think you need to file taxes, doing so might be beneficial. Taxpayers could be eligible for tax credits, refunds, and even government benefits.

When can you start filing 2026 taxes?

The IRS announced Jan. 26, 2026, as the start of the 2026 tax filing season.

Be aware of tax deadlines

Knowing how to do taxes is important, but it won’t matter if you don’t get them in by the federal deadline. For most of us, the deadline to file taxes is April 15. If you request an extension, your due date will be October 15, but you must still file the extension by April 15.

The deadline for state income tax filings is the same as the federal tax filing deadline. Luckily, you can file both taxes at the same time.

There are currently nine states that don’t have a state income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- Texas

- South Dakota

- Tennessee

- Washington

- Wyoming

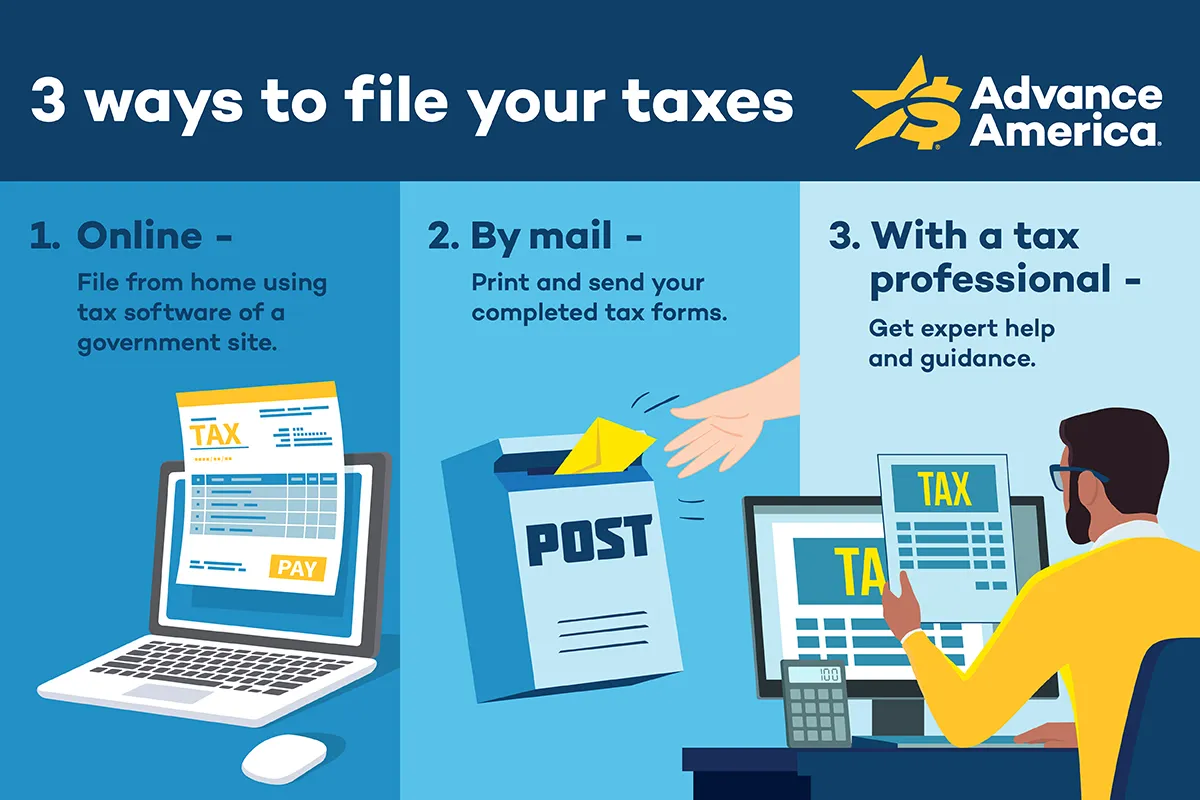

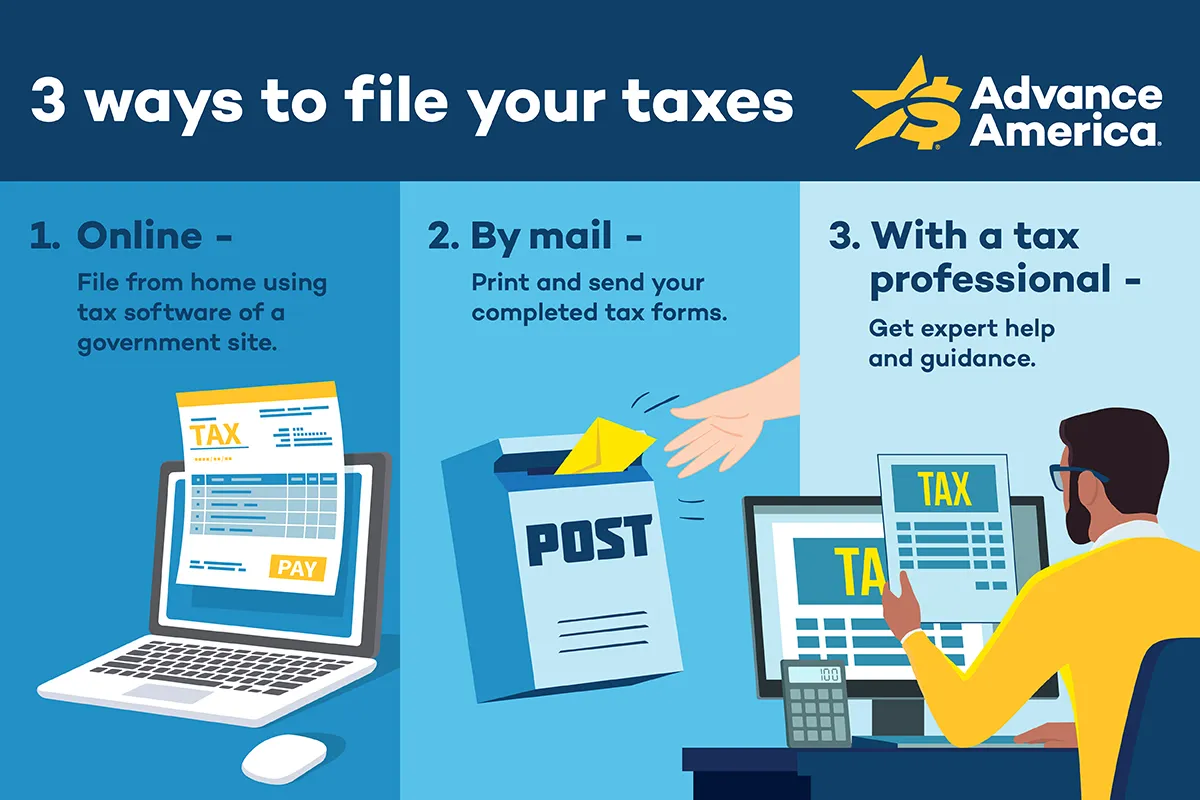

What are the 3 best ways to file your taxes?

1. File taxes online

Filing online is the fastest and easiest option. It’s also the best way to familiarize yourself with the tax filing and preparation process. Use e-filing software that guides you through the process from start to finish.

All you need to do is choose your program, create an account, and follow the built-in steps. It will likely ask you questions about your income, employment status, and life in general, then help you fill out the proper forms. There are numerous online filing options, including:

- H&R Block

- TurboTax

- TaxAct

- Tax Slayer

Qualified taxpayers earning under a certain amount can even take advantage of the IRS Free File program.

2. Hire a tax preparer

If you feel overwhelmed at the idea of doing your own taxes, it’s best to hire a tax preparer, such as a certified public accountant (CPA).

CPAs are the foremost experts in tax filing. They typically hold a bachelor’s degree in accounting and spend years learning to prepare tax returns. As such, they can help you avoid costly tax filing errors and ensure you remain in the good graces of the IRS.

3. File taxes by hand

You can print your tax forms and file by hand, which is the most time-consuming option. It isn’t recommended unless you’re an accountant or can file taxes independently.

Completing paperwork can increase the risk of errors on your tax return. For example, you might:

- Choose the wrong form

- Enter inaccurate information

- Miscalculate deductions or credits

- Select the wrong filing status

- File too late

Mistakes can lead to filing delays, potential fines, audits, and even jail time.

How to file your taxes: step-by-step

1. Choose how you want to do your taxes

First things first, you need to decide which of the above tax filing options you want to use:

- Filing by hand: The cheapest option, but also the most difficult.

- File taxes online: Easy and less risky. Can be expensive depending on which platform you choose.

- Hire a tax preparer: Ensures your taxes are done correctly. Costs can vary anywhere from $50 to $300.

2. Figure out what information you’ll need

Regardless of which tax filing method you use, you’ll need to provide the following details:

- Tax identification number, Social Security number, or employer identification number

- Bank routing and account number

- Identity Protection PIN (if the IRS has issued you one)

- Driver’s license (required in some states)

- Dependent information

- Spouse’s details (if married and filing jointly)

- Adjusted gross income and refund amount from your last tax return

- Current address and proof of address change, if necessary

- Proof if you were the victim of identity theft

3. Gather all necessary documents

In addition to personal information, you’ll also need a wide range of financial information and documents to complete your tax return. Your tax-filing checklist typically includes:

- Employer-provided W-2

- Self-employed 1099

- Paid interest statements for your student loans or mortgage

- Unemployment payments

- Savings, investments, or dividend statements

- Retirement account contributions

- Charitable donation statements

- Medical bills

- Any stimulus payment information

- Your taxes benefits

- 1098-T form for education credits (if you’re a college student)

- Any additional income

Not every item above may apply. Depending on your circumstances, you may have been sent other forms you’ll need to refer to when filing.

You should receive most tax documents automatically. However, check with your employer, student loan carrier, or investment company if you haven’t received the appropriate form in the mail by January 31st. You may need to download these electronically.

4. Fill out your tax forms

At this point, if you’re filing your own taxes by hand or online, you’re ready to complete your federal and state tax filing forms. Detailed instructions are included in each document; follow them precisely as outlined.

If you plan to use a professional tax preparer, take all necessary forms to their office. They will either fill them out for you or walk you through the process. Depending on the preparer, they may request that you leave your tax-filing information with them, and they’ll contact you when they’re finished.

5. Submit your taxes to the IRS

You should file your taxes according to the tax-filing method you chose. Once you’ve completed your tax forms using an e-filing platform, you can submit them automatically. Any professional tax preparer you hire will usually file them electronically on your behalf, but some may mail the return.

If you’ve completed your tax return manually, mail it to the address provided on the form. Tax returns must be postmarked by the deadline; otherwise, you could face penalties.

6. Settle your account with the IRS

After you file your taxes, you will either owe more money or receive a refund. If you receive a refund, the IRS will issue it by check or deposit it directly into your bank account. It can take several weeks to receive your refund, but opting for a direct deposit is typically the fastest option.

If you didn’t withhold enough taxes during the year, you may owe money to the IRS. When this happens, there are several ways to settle your account. You can pay online via wire transfer or credit or debit card, or by mail with a personal check. Depending on the amount, you may be able to set up a payment plan.

Can you get cash from your tax refund in advance?

According to the IRS, approximately 90% of tax refunds are deposited within 3 weeks. But if you’re waiting on your tax refund and an unexpected bill arises, a tax rebate Cash Advance is a great way to get cash secured against the refund the IRS will issue. Once the IRS issues your refund, the lender is paid directly and you receive the remaining refund into your bank account.

What makes these tax refund advances so popular is that they’re easy to apply for, typically don’t require good credit, and provide fast access to cash when you need it.

MORE ON TAXES

- How Early Can You File Your Taxes?

- How To Get a Tax Refund Advance Loan

- What Is the Earned Income Tax Credit?

- Reasons To File a Tax Extension

Tax resources and tax forms

Helpful resources:

- IRS Free File

- Child Tax Credit

- IRS Payment Plans and Information

- Application for Automatic Extension of Time to File Taxes

Tax forms:

The IRS has a comprehensive website with additional tax forms and information to meet your needs. If you're nearing the April 15th deadline and still haven’t filed your taxes, it’s important to act quickly to avoid penalties and fines.

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.