Cashier's Check vs. Money Order: What’s the Difference?

When you need a secure way to send or receive money, cashier’s checks and money orders are two reliable options. Both offer guaranteed funds, making them safer than personal checks — but they’re not quite the same.

Whether you’re paying a bill, making a big purchase, or sending money to a loved one, understanding the difference between a cashier’s check and money order can help you choose the right option with confidence.

What is a cashier’s check?

A cashier’s check is a secure form of payment issued by a bank or credit union. Unlike a personal check, which pulls funds directly from your account, a cashier’s check is backed by the bank’s own money. That means it’s guaranteed, so there’s no risk of bouncing.

Here’s how it works: The bank verifies that you have enough in your account, withdraws that amount, and issues the check in the recipient’s name. The money is then held separately, so the check is as good as cash.

Because of that security, cashier’s checks are often used for high-dollar transactions — like buying a car, putting a down payment on a home, or paying a security deposit. They usually clear faster than personal checks, often within one business day.

Where to get one: Start by visiting your bank or credit union. They’ll walk you through the process.

Benefits of a cashier’s check

- Guaranteed funds: Backed by the bank, so the payment won’t bounce.

- Faster processing: Typically clears within one business day.

- Higher payment limits: Can be used for large transactions, unlike money orders.

- Enhanced security: Built-in features help prevent fraud and counterfeiting.

- Widely accepted: Preferred for major purchases like cars or home down payments.

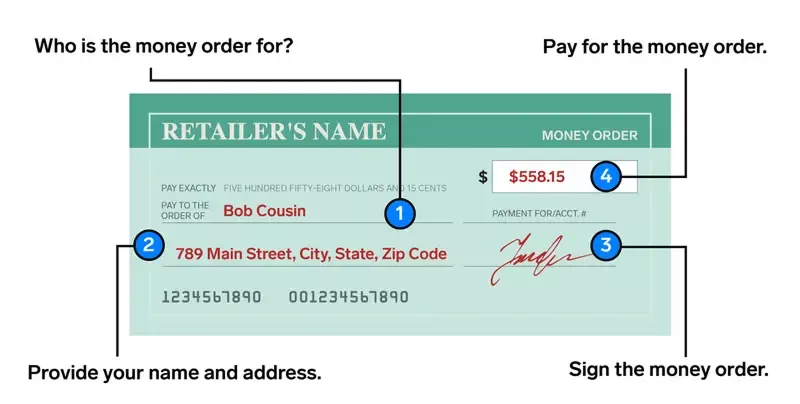

What is a money order?

A money order is a prepaid, secure way to send money — kind of like a check, but without needing a bank account. You pay the full amount upfront (plus a small fee), and the money order is issued in the recipient’s name.

Here’s how it works: Once it’s issued, the money order can only be cashed or deposited by the person it’s made out to. This makes it a safe option for rent, bills, or sending money overseas or by mail. It’s also helpful if you don’t use a traditional bank.

Most money orders have a limit (often around $1,000), and they can be tracked or canceled if lost or stolen.

Where to get one: You can pick up a money order at most banks, post offices, retail stores, and even at your local Advance America.

➢RELATED: How to Track a Money Order

Benefits of a money order

- No bank account needed: You can purchase or cash a money order without having a checking account.

- Secure payment: It’s made out to a specific person, which helps prevent fraud or theft.

- Easy to find: They’re widely available at places you already shop or do business.

- Trackable: You’ll get a receipt with tracking details, so you can confirm if it’s been cashed.

- Safer than cash: Lost it? No worries — money orders can often be canceled or replaced.

Cashier’s check vs. money order

Both options are secure payment methods, but they serve different purposes depending on your situation. The biggest difference comes down to cost, convenience, and how much money you’re sending.

When should you use a cashier’s check vs. money order?

Use a cashier’s check when:

- You’re making a large payment — like a down payment or security deposit.

- The payee requires guaranteed funds for added security.

- You want faster clearing and a bank-backed guarantee.

Use a money order when:

- You don’t have a bank account.

- You’re sending a smaller amount — usually under $1,000.

- You need something quick, low-cost, and easy to find.

Money orders are also easier to replace if they’re lost or stolen. Replacing a lost cashier’s check, on the other hand, can take longer and may require an indemnity bond.

[Original table]

Which is better?

That depends on what you need. If you’re looking for convenience and lower fees, a money order might be your best bet. If you’re making a bigger purchase and want added security, a cashier’s check offers more peace of mind.

Which costs less?

If you’re looking for the most affordable option, money orders tend to cost less. Fees typically range from a few dollars up to $10. In some cases, you might even find fee-free promotions. Cashier’s checks tend to cost more, with fees often between $10 and $20 depending on the bank.

How long are money orders and cashier’s checks good for?

Money orders and cashier's checks don’t technically expire, so you can hold onto them until you’re ready to use them.

That said, it’s a good idea to check with the place where you got it. Some banks or financial institutions may include fine print about expiration or service fees if the item isn’t used within a certain period (usually a couple of years).

Alternatives to cashier’s checks and money orders

If a cashier's check or money order doesn’t fit your needs, you’ve still got options:

Credit cards

Credit cards are widely accepted and easy to use for everyday purchases — online, over the phone, or in person. They’re a convenient way to pay, as long as the recipient accepts them.

Certified check

A certified check is written from your personal account, but it’s verified and stamped by your bank to guarantee the funds. Just keep in mind, not all businesses accept checks, so it’s smart to check first.

Wire transfer

Need to move money fast? A wire transfer lets you send funds directly from one bank account to another, either online or at your branch. Most transfers are completed within one to two business days.

Cash

Cash is accessible and widely accepted, although more businesses are starting to move away from cash-only payments. It’s also not the safest option — if the money is lost or stolen, you usually can’t get it back.

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.