How to Establish Credit: A Beginner’s Guide

Starting from scratch? Establishing credit is simpler than you might think.

With a few beginner-friendly tools — like secured cards, credit-builder loans, or becoming an authorized user — you can start building a positive credit history in months. This sets the foundation for long-term financial confidence and access to opportunities like renting an apartment, qualifying for loans, and managing utilities more easily.

How credit works

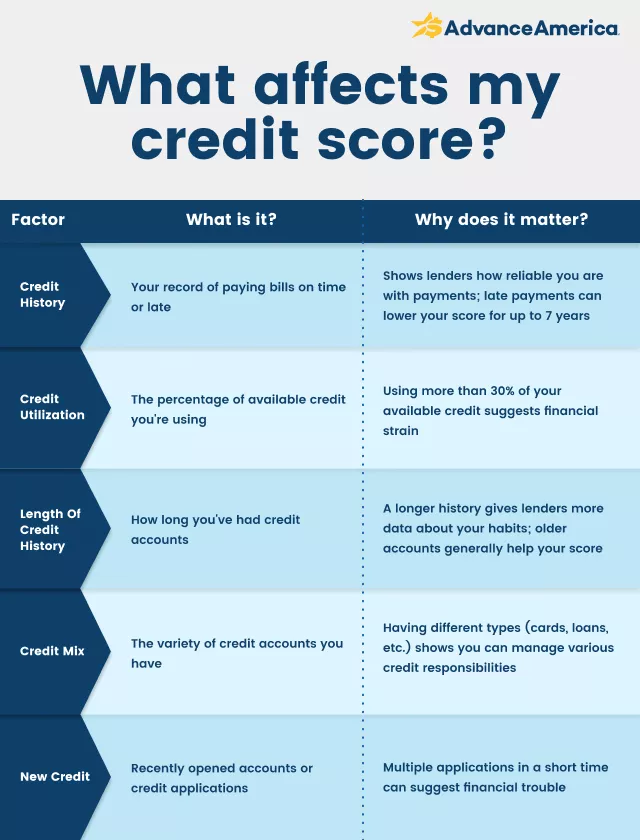

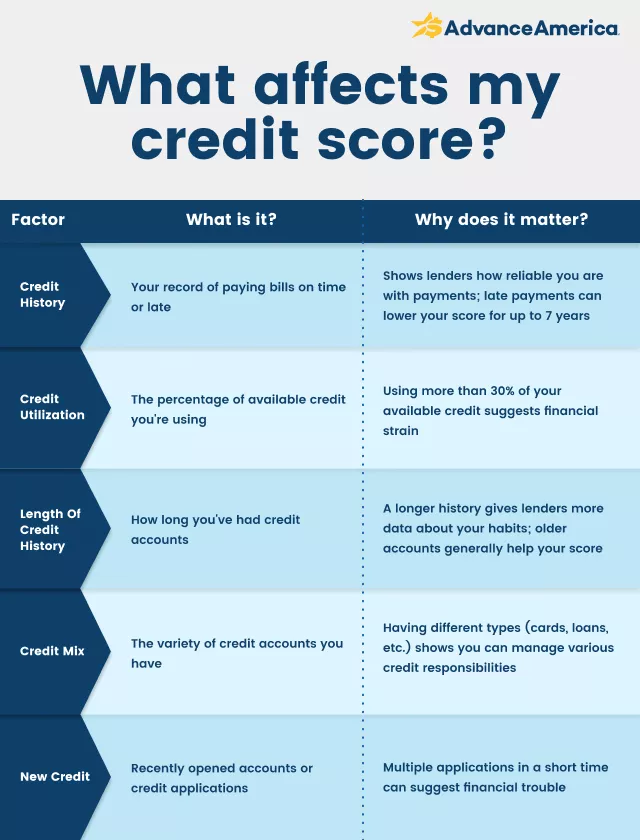

Credit is a record of how you borrow and repay money, represented by a number known as a credit score. Lenders, landlords, and even some employers use your credit history to assess financial responsibility.

A good credit record makes life smoother — from renting apartments to qualifying for loans.

Key terms to know about credit:

- Credit report – A detailed record of your credit accounts and history.

- Credit history – Your past borrowing and repayment behavior.

- Credit utilization – How much credit you use compared to your limits; lower is better.

- Credit mix – The variety of credit types you have, like credit cards, loans, and installment accounts.

➢RELATED: What Affects Your Credit Score?

Why establishing credit matters

A good credit history is more than just a number — it’s a tool to manage your financial life. Credit helps lenders, landlords, and some employers assess your financial responsibility.

Even a small credit history can unlock big opportunities, such as:

- Renting an apartment: 70% of landlords check credit before renting.

- Getting loans or credit cards: Banks use credit history to decide approval.

- Mobile phone & utility accounts: Some require a credit check for new service.

- Employment: Certain roles involve credit checks, especially in finance.

A positive credit record today makes borrowing easier, cheaper, and less stressful in the future.

💡Tip: Starting with just one small account can make a difference for your long-term goals.

➢RELATED: Understanding the Different Types of Credit Scores

Simple ways to start building credit

Here are practical steps to establish credit from scratch:

1. Get a co-signer 🤝

A co-signer shares responsibility for your credit account. They either apply jointly with you or guarantee the loan.

- How it helps: Can make it easier to get approved for a credit card or loan and helps you build credit if payments are made on time.

- Tips: Choose someone you trust who has a strong credit history; maintain clear communication about payments.

- Considerations: Missed payments can negatively affect the co-signer’s credit.

2. Become an authorized user 🪪

You can be added to a family member or friend’s credit card account.

- How it helps: Payments on that card appear on your credit report, helping you build history without opening a new account.

- Tips: Make sure the primary user manages their account responsibly—on-time payments are essential for your credit.

- Considerations: Your credit is tied to the primary user’s activity; missed payments can affect your score.

3. Get a secured credit card or credit-builder loan 🔒

A secured credit card requires a refundable deposit (usually $200–$500) that sets your credit limit. A credit-builder loan is a small loan held until you make all the payments — sort of like a loan in reverse.

- How it helps: Builds your credit history when payments are made on time.

- Tips: Open an account, make on-time payments each month, and monitor your credit report for updates.

- Considerations: Secured cards require a deposit; credit-builder loans may have interest.

4. Explore student or beginner-friendly credit cards 🎓

Student credit cards are designed for first-time borrowers, offer low limits, and don’t require large deposits. Gas and retailer credit cards are often easier to get approved, may offer rewards, and build credit if on-time payments are reported.

- How it helps: Establishes a credit record with low risk for first-time users.

- Tips: Keep balances low and pay in full each month to avoid interest.

- Considerations: High interest rates may apply; limited use outside the store for retail cards.

5. Consider rent and utility reporting 🏘️

Some third-party services can report utility and rent payments to credit bureaus. Since these are likely your largest monthly expenses, having them count toward your credit can help establish your on-time payment history.

- How it helps: Builds credit history without requiring a card or loan.

- Tips: Confirm that your landlord or utility provider participates.

- Considerations: Not all landlords or bureaus participate, so eligibility may vary.

➢RELATED: Can You Get a Loan With a 400 Credit Score?

How long does it take to build credit?

Most beginners can see a credit score after 6 months of responsible activity by doing the following:

- Month 1–2: Open first account

- Month 3–6: Make consistent payments

- Month 6+: First score appears on report

Factors that affect progress include:

- Timely payments

- Credit utilization ratios

- Account types (revolving vs. installment)

💡Tip: Use a reminder app or calendar to track payments and monitor your progress. Small steps matter!

Check your credit report and score

Once you’ve started building credit, it’s important to check your free credit report at least once a year — or more often if you’re actively building credit or want to spot mistakes early. When you review it, focus on your payment history, balances, recent inquiries, and account types to make sure everything looks accurate.

Staying on top of your report helps protect the hard work you’ve put into growing your credit, since even a single error can make a big difference.

Tips to improve your credit over time

- Make consistent on-time payments: Always pay at least the minimum by the due date. • Keep credit utilization low: Aim to use under 30% of your available credit.

- Avoid opening too many accounts at once: Too many inquiries in a short time can lower your score.

- Keep old accounts open: Long-standing accounts strengthen your credit history.

- Build a healthy credit mix: Combining revolving (cards) and installment (loans) accounts shows financial responsibility.

➢RELATED: What Bills Help Build Credit?

Common credit myths vs. truths

Myth: You need a lot of money to start building credit

Truth: You can start with small deposits and low-limit secured cards or credit-builder loans.

Myth: Checking your credit score hurts it

Truth: Checking your own credit won’t affect your score. Only hard inquiries that are run when you apply for credit will temporarily lower your score.

Myth: Credit is only for borrowing

Truth: Credit history impacts things like renting, employment, and insurance, so building credit can help in areas of your life besides borrowing money.

Myth: You must pay all debt off immediately

Truth: Making on-time payments matters more than how quickly you pay off debt.

Get started building your credit

You don’t have to wait to start building credit. Small steps today can make a big impact. Open a secured card, become an authorized user, or report your rent payments to get credit for the bills you’re already paying.

Pair these moves with simple tools like budgeting apps or credit monitoring to stay on track and see your progress grow.

Every small step counts toward building your financial future.

FAQs about building credit

What’s the fastest way to establish credit?

Becoming an authorized user or opening a secured card or credit-builder loan can help start your credit history in a few months.

Can I build credit without a credit card?

Yes! Other types of lenders, such as those issuing store charge cards and personal loans, often report to credit bureaus, which can help you build credit.

Can I build credit if I’m new to the US?

Yes! Start with secured cards, credit-builder loans, or authorized user options. Some services also report rent payments.

How often should I check my credit report?

Check it at least once a year and after opening new accounts to ensure accuracy.

Will applying for a credit card hurt my score?

You may experience a small, temporary drop in your credit score after applying for any new credit. But using a credit card responsibly often outweighs this minor effect.

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.