How Do Title Loans Work?

Did you know your car might just be the key to the money you need? Title loans are a type of secured loan that uses your vehicle as collateral, allowing you to borrow a percentage of your car’s appraised value.

Let’s explore how title loans work and where you can get one online.

What is a title loan?

Title loans are short-term loans you’ll either repay over time or in a lump sum payment. You must own your vehicle outright and have a free and clear title in hand to get a title loan. That’s because the lender will hold onto your title until you repay the loan in full, but you can continue driving your vehicle as you make payments.

How do title loans work?

The application and approval process varies by lender. In most cases, if you apply for a title loan in person, the lender will appraise your vehicle on the spot.

If you apply for an online title loan, the lender will provide details on when and where you can meet with an appraiser to determine your car’s value. Either way, the loan amount you receive will be based upon the vehicle’s appraised value.

Once your title loan application is approved, you may receive your money right away in the form of cash or direct bank deposit.

Benefits of title loans

Here are some benefits of getting a title loan:

Easy application process

Title loan applications are usually quick and easy, often taking just minutes to complete. Once you bring your car to the title loan lender or appraiser, your car undergoes a brief inspection.

Quick approval

Depending on the lender, you may receive an approval decision as soon as you’ve completed your application. You may get a preliminary loan offer prior to the vehicle appraisal, but the offer won’t be finalized until after the lender verifies your car’s value.

You don’t need good credit

Since a title loan is a type of secured loan, you don’t need good credit to get approved. Many title loan lenders have lenient or no credit requirements, so you may still get approved for a title loan with poor or fair credit.

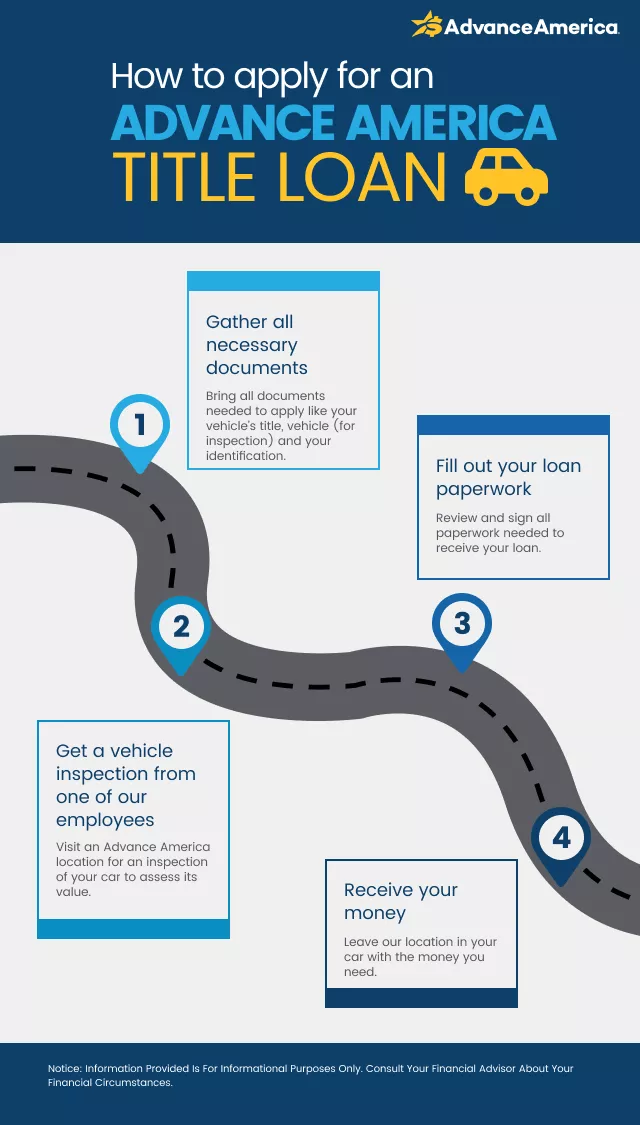

How to apply for a car title loan

Not all states regulate title loans. Before applying for one, look online to compare loans available in your area. If title loans are offered in your state, here’s what you can expect from the title loan application process:

- Gather your vehicle’s title along with your identification. Certain states may also require proof of residency (like a utility bill), proof of income, and proof of auto insurance.

- Drive your car to the lender or appraisal location. Be sure to verify the lender is legit.

- Authorize an inspection of your vehicle to determine its value.

- Fill out and sign your loan paperwork.

- Leave the lender in your vehicle with your loan money in hand or in your bank account.

Can title loans affect my credit score?

Generally, applying for a title loan won’t affect your credit score, which may be a pro or a con depending on your situation.

When you apply, title lenders typically don’t run a hard credit inquiry. While this won’t negatively impact your FICO credit score, you won’t get a credit boost either because title lenders typically don’t report your payment activity to the credit bureaus.

How much can I borrow with a title loan?

The amount of money you can borrow varies by lender and state regulations where title loans are allowed. In general, a title loan amount can range from 25% to 50% of your vehicle’s appraised value.

Title loans vs. other loan options

Title loans are secured short-term loans based on the value of your vehicle. But what if you’re still making car payments? Or you don’t have a car at all? Here are other loan options to consider:

- Installment Loans: With an Installment Loan, you can borrow the lump sum of money you need with a fixed term, ensuring your monthly payments are consistent.

- Payday Loans: Payday Loans are small-dollar loans you typically repay within two to four weeks on your next scheduled payday.

- Line of Credit: Opening a personal Line of Credit gives you access to an approved maximum borrow amount, which you can draw from in smaller increments as needed.

What can I use a title loan for?

Title loans can be useful for covering emergency expenses like medical bills, appliance repairs, or higher-than-expected utility bills.

What happens if I don’t repay a title loan?

If you don’t repay a title loan, the lender repossesses your vehicle and sells it to recover the money you borrowed. This is why you should carefully consider if a title loan is right for you.

Consider a title loan for financial emergencies

Being able to use your car’s value as collateral and not having to worry about a credit check means you may have a good chance of getting approved for a title loan. If you own your vehicle and need money quickly to cover expenses, this is one type of loan you might consider.

We’ve partnered with LoanCenter to connect you with loan options best suited to your financial situation and budget. Apply online now to get the money you need today.

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.