Bad Credit Line of Credit

Qualifying for a traditional personal loan can be difficult with a poor credit score. If you need emergency funding but are concerned about your credit history, consider a personal Line of Credit from Advance America.

A Line of Credit is a flexible loan that allows you to access money whenever you need to cover unexpected expenses. Alternative lenders often offer easy online applications, same-day approvals, and good approval odds for borrowers with less-than-perfect credit. Because of this, a Line of Credit may be a viable option even if you have a poor or fair credit history.

Let's examine this type of unsecured loan, how it works, and whether a personal Line of Credit is right for you.

How does a Line of Credit work?

Opening a personal Line of Credit for bad credit can give you access to money whenever you need it — up to a set credit limit. Once approved, you'll have access to a certain amount of funds you can borrow from as needed.

For example, let's say you're approved for a $1,000 Line of Credit. You only need $250 right now to cover a bill, so you draw $250. You still have $750 remaining in your credit line. So, whether you need another $50 or the remaining $750, it’s up to you how and when you use those funds.

Plus, you’ll only pay interest on the amount you borrow, not your total credit limit.

At Advance America, you can pay back the amount borrowed from your personal Line of Credit all at once or over time. There are no prepayment penalties, and your Line of Credit stays open even if you repay what you borrowed, so it's there for you when you need it.

Types of Lines of Credit

There are typically three different types of credit lines to choose from:

Personal Line of Credit

A personal Line of Credit is the most accessible option. Personal Lines of Credit are unsecured loans that do not require any form of collateral. The amount you could receive through a personal Line of Credit is usually based on your credit score, income, employment, and other financial factors.

At Advance America, we look at factors beyond your credit score, such as your income and employment, when reviewing your Line of Credit application. Your approved credit line amount will depend on those factors and your state’s regulations.

As with other types of loans, once you receive funds for your personal Line of Credit, you can use it for whatever you want. This includes home renovations, medical bills, ongoing utility expenses, and more!

Home equity line of credit (HELOC)

While most Lines of Credit are unsecured, a home equity line of credit (HELOC) is an exception. HELOCs are secured loans with amounts based on the amount of equity you have in your home.

Equity is the difference between how much you still owe on your home and how much it’s worth. Therefore, the more you pay off your home or the more value you add to it, the more money you can receive from a HELOC.

Home equity lines of credit can be great for large, ongoing expenses such as home improvements, medical bills, and student loans. You typically have access to larger sums of money with a HELOC than a personal Line of Credit, but you also need to own your home.

Another downside to a HELOC is that they come with additional costs, including closing costs. You also risk losing your home if you can’t repay what you borrow.

Business line of credit

As the name indicates, a business line of credit is a type of unsecured loan specifically for business owners. With a business line of credit, you can borrow large sums of money, often up to $250,000 or more, and use the funds to improve your business or pay for expenses.

The size of your loan will depend on how valuable the lender thinks your business is. While business lines of credit can help you increase sales and boost your business in the short term, they tend to have high interest rates and can be difficult to repay.

Unsecured vs. secured Lines of Credit

Like many personal loans, a Line of Credit can be secured or unsecured. With a secured Line of Credit, you provide some type of asset as collateral. If you default on the loan, however, the lender can repossess the asset to recoup the loss.

For example, a HELOC is a secured credit line because it uses a borrower's home equity or property value as the asset to secure the loan. Secured loans may be easier to obtain when you have bad credit because the lender knows they can seize the collateral if you fail to repay the debt.

In contrast, unsecured Lines of Credit are not backed by collateral, which means you won't lose an item of value if you can't repay the loan. However, you may find it more difficult to qualify for an unsecured loan or credit line through a traditional lender if you have a poor credit history.

Can I get a Line of Credit with a poor credit score?

Possibly, but you'll still need to meet the lender’s eligibility requirements. You also may not be able to go through a traditional lender like a bank or credit union.

Direct lenders like Advance America offer competitive and affordable Lines of Credit. Bad credit or the lack of a credit score doesn’t automatically disqualify you from getting the money you need. As a result, your approval odds for a Line of Credit may be better with us than with traditional lenders.

Can I get one online?

Of course! Potential borrowers with bad credit can apply for a personal Line of Credit through an online lender. Many lenders either operate entirely online or offer online services in addition to their storefronts, meaning you can fill out an online application, get approved, and receive quick funding without ever leaving home.

Plus, applying for a Line of Credit online streamlines the process, making it easier to get the cash you need quickly. In fact, if your online lender offers same-day funding, you may receive your first draw amount via direct deposit within hours.

What can I use a bad-credit Line of Credit for?

Whatever you need! Having an open Line of Credit gives you access to extra money whenever you need it, allowing you to cover anything from daily essentials to major expenses.

You can also use a Line of Credit as an added financial cushion to cover groceries, student loans, or utilities when you're running low on funds. Just remember that once you've reached your credit limit, you can't borrow more until you've paid down some of the debt.

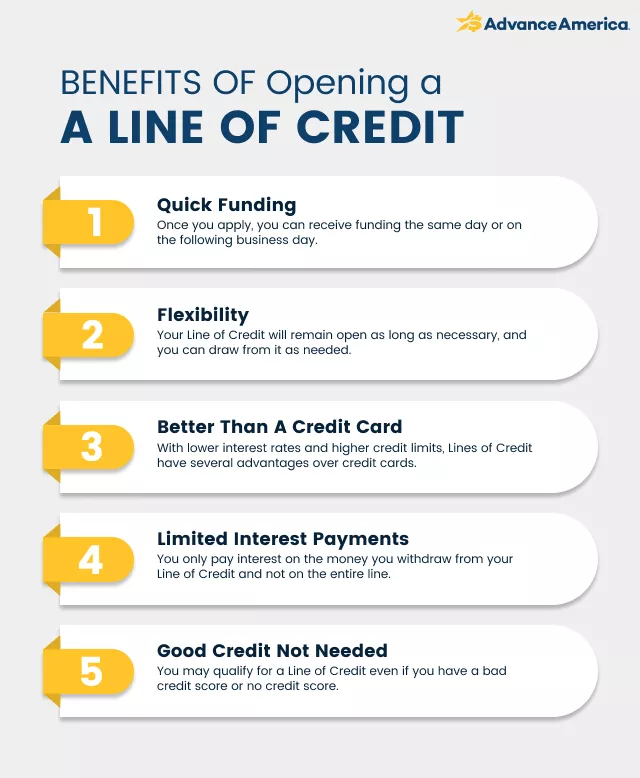

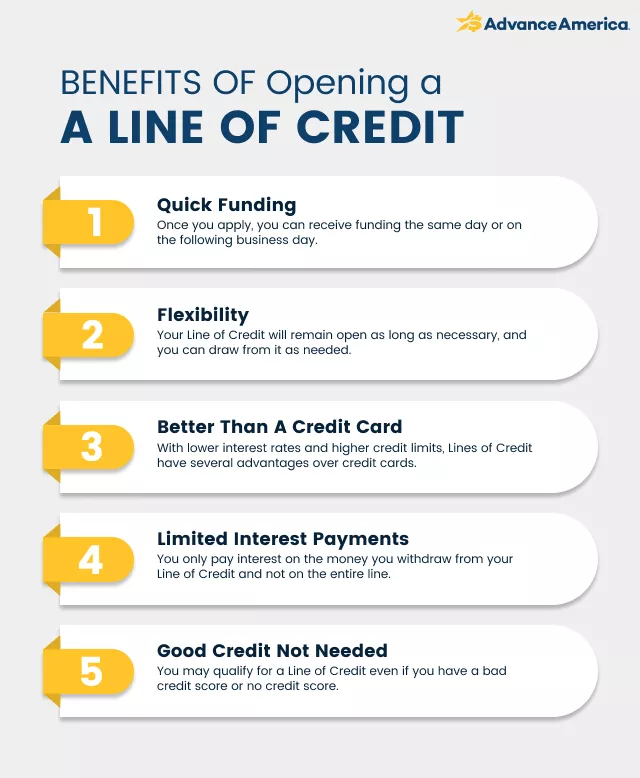

Key benefits

Having a poor credit history can limit your access to conventional personal loans and credit cards. Fortunately, personal lines of credit offer several advantages compared to other types of bad-credit loans. Here are a few key benefits:

Quick funding

When you apply for a bad-credit Line of Credit, you won't have to wait several business days or weeks to access your funds. In fact, if you apply for an Advance America Line of Credit before 10:30 AM ET, you could receive your funds the same day! In other cases, you may have access to your Line of Credit by the following business day.

Flexibility

A personal Line of Credit can be a great choice if you're not sure how much money you want to borrow. Unlike a personal loan or Cash Advance, an open Line of Credit gives you access to funds that you can tap into as needed.

Could be better than a credit card

A Line of Credit is similar to a credit card in that you’re approved for a set limit and can borrow up to that limit. Unlike credit cards, however, Lines of Credit often have higher credit limits and lower interest rates. Depending on your needs, these factors can make a Line of Credit a better fit.

Only pay interest on what you borrow

Compared to other types of personal loans, a Line of Credit can be more affordable because you only pay interest on the amount you withdraw. For example, if your personal Line of Credit is $2,000 and you borrow $500, you'll only be responsible for interest on the $500 until you withdraw more.

Good credit not needed

Many lenders don't require you to have a minimum credit score to qualify for a bad-credit Line of Credit. So, even if you have poor credit or no credit at all, you may still get approved based on other factors like your employment and income.

What you'll need to apply

To apply for a personal Line of Credit with bad credit, you'll need to provide proof of your identity and your ability to repay the amount you borrow. Many lenders that offer bad credit loans require some or all of the following:

- A government-issued ID (i.e., driver’s license, passport)

- Proof of income (i.e., bank statements, pay stubs, tax returns)

- Checking account

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

Since state laws vary, you'll want to check with your lender for a list of required documents. Requirements may also vary depending on whether you apply online or in person.

How to get a Line of Credit

with bad credit Getting a Line of Credit with a bad credit score is easier than you might think. Here's what you need to do:

Compare lenders

Shop around and look for reputable lenders that offer personal Lines of Credit. Bad credit can affect whether you qualify with certain lenders, so make sure they’re willing to consider other factors beyond your credit score. You should also compare interest rates, loan terms, prepayment penalties, storefront locations, and customer reviews to make an informed decision.

Get ready to apply for the Line of Credit

Once you've compared your options and decided on a Line of Credit, read the fine print. You need to know all the details before applying so you know what to expect. Also, make sure you gather all the required documents and personal information needed to complete the application.

Complete and submit your Line of Credit application

Fill out your application for a personal Line of Credit online or in person. In some cases, you may have to specify your first draw amount in the application. Before hitting the submit button, review the information you entered to check for accuracy.

Receive your first draw amount

If you're approved for a Line of Credit with bad credit, the lender will give you access to funds that you can use up to your credit limit. It's important to never withdraw more than you need so you won't have trouble making your monthly payment or repaying the balance.

How does having a Line of Credit affect your credit score?

When you have bad credit, a Line of Credit may positively affect your credit score. For instance, opening a Line of Credit can:

Increase your available credit

Your credit utilization, or the total debts you owe divided by your total credit limits, accounts for about 30% of your credit score. A good rule of thumb is to keep your credit utilization ratio below 30%.

Getting a Line of Credit can increase your available credit, which can lower your credit utilization ratio and increase your credit score. Just make sure you don't use more than 30% of your credit limit since this can have a negative impact on your score.

Boost your payment history

Your payment history makes up about 35% of your credit score. By opening a Line of Credit, you have an opportunity to prove you can make your payments on time. When you make your monthly payments on time, your credit score can start to improve. But try to avoid any missed or late payments, as these can bring down your score.

Diversify your credit mix

Your credit mix accounts for about 10% of your credit score. That may not sound like much, but getting a Line of Credit for bad credit can add to the types of accounts you have on your credit report, which can improve your credit score. For example, if you only have credit cards and an auto loan, adding any type of personal loan diversifies the kind of credit you have on your credit report.

Is a Line of Credit right for me?

A Line of Credit can be a great source of emergency funds when you need them most. Like any type of loan, credit lines aren’t a fix-all and may not be right for you. You should consider one if you:

- Need more money than you can receive with another type of personal loan, such as a Payday Loan or an Installment Loan.

- Need access to ongoing funds for the next several months or years.

- Prefer revolving funds that you can access whenever necessary, up to your credit limit.

- Have an upcoming home renovation or other large, recurring expense.

Get an Advance America Line of Credit with bad credit

Advance America offers loan options to borrowers with bad credit, fair credit, or no credit. What we look for is your ability to repay what you borrow, which means considering your employment and income in addition to your credit history.

Apply now or stop by your nearest Advance America branch to learn more about personal Lines of Credit and other personal loan options.